AMI LLPA Waiver

AMI LLPA Waiver for Freddie and Fannie

As you may be aware, Freddie and Fannie announced in November a pricing enhancement targeted at First Time Home Buyers who have a total qualifying income at or below the Area Median Income (AMI).

GMFS has updated our pricing engine to capture this great benefit! This can be significant to the borrower’s initial rate depending on the FICO, LTV and loan size.

For example, in today’s environment a 640 FICO at 95% could be up to 1% to 1.5% better interest rate!

These changes are now automatic in our system and easily identifiable. As of Friday, January 6th, the Loan Program will have an append to the name to indicate the AMI Waiver was used (example: GMFS-Fannie 30 Yr AMI Waiver).

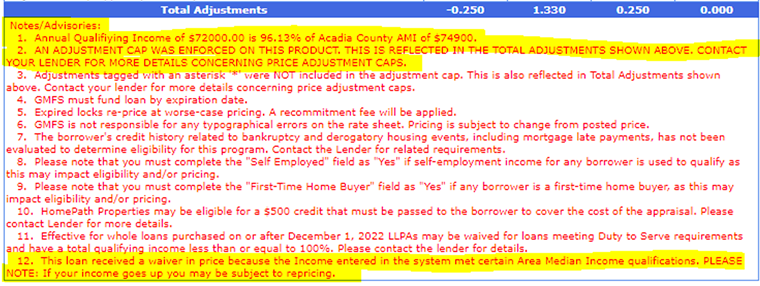

You will also see notations in the Optimal Blue Findings as shown highlighted below:

IMPORTANT TO NOTE:

- This waiver will not be indicated on the Home Ready / Home Possible products since those products themselves already have the LLPA waiver on all loans (not just FTHB).

- If the income filed is blank, the AMI waiver will not be triggered.

- YOU MUST pay close attention to your borrower’s income. Before you lock the loan and accept the waiver, the total qualifying income is required to be entered in the file. If you accept the lock and the total qualifying income changes, you will be subject to repricing.

*If your loan was locked prior to January 6th, it may have received the AMI Waiver and the Loan Program name will not be appended. Please review your notes in Optimal Blue on FTHB. You will be subject to repricing if your income increases about 100% AMI.