GMFS Pricing Adjustment for Investment Properties and Second Homes

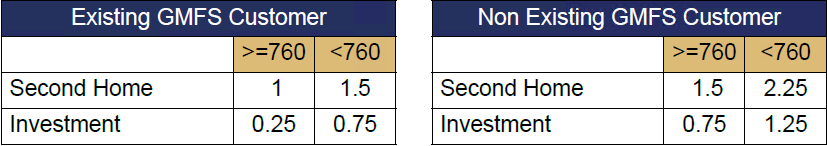

In response to the recently announced Fannie / Freddie cap on investment property and second home transactions, GMFS will be adjusting our loan level price adjustments for second home and investment properties (NOO), effective for any commitments taken on or after Thursday, March 25, 2021.

In order to qualify as an existing GMFS Customer, borrower must have an Owner occupied primary mortgage with GMFS. Borrower is eligible for the Existing Customer pricing stated above if you close a Primary Mortgage and Second Home/ Investment concurrently. *Please refer to the existing guideline for lender credit related to clients that currently have a mortgage with GMFS. Second Home and Investment will not be eligible for the lender credit.

*Existing guideline for lender credit: In order to qualify as an existing GMFS Customer, borrower must have an active mortgage with GMFS. To receive lender credit existing mortgage must have matured past 6 payment dates. This new offer replaces the Free Appraisal Waiver for borrowers who’s existing loans were serviced by GMFS.