Sharing of Borrower Tax Return Information by Lenders

Borrower Consent to the Use of Tax Return Information Changes

The Taxpayer First Act was signed into law on July 2, 2019 and effective December 28, 2019. The law requires any person/entity that receives tax return information to obtain express permission from the taxpayer before sharing that information with other parties.

Because mortgage lenders share taxpayer information with other service providers involved in the origination of a mortgage loan, mortgage lenders will be required to obtain written consent from each applicant whose taxpayer information may be shared.

Therefore, for all loans with an application date on or after December 28, 2019, GMFS will require a written, signed taxpayer consent form for each applicant.

For your convenience, the form is now available on our website.

The consent may be wet signed, or electronically signed through a reputable e-sign provider.

A copy of both the e-consent form (when signatures are obtained electronically) and the taxpayer consent form must be included in the client submission package that is uploaded to the TPO Connect portal.

Loans submissions without this form will be conditioned.

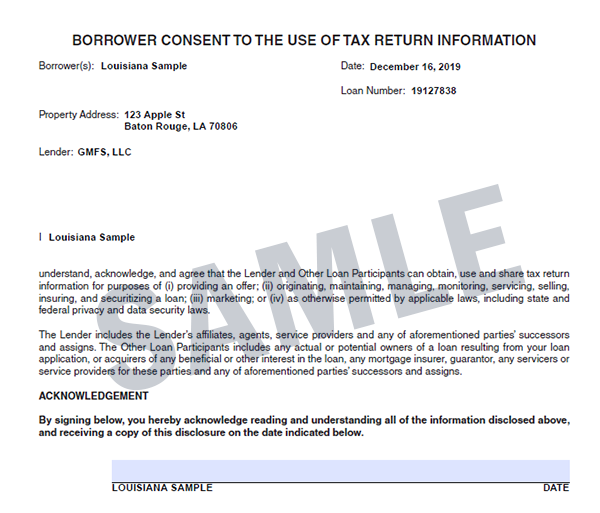

A sample of the taxpayer consent form is included below. GMFS recommends that you contact your loan origination system provider and/or your document provider to ensure this form has been included in your standard disclosure package.