Lender Paid Buydowns Available for Conventional

Lender Paid Buydowns for your borrowers on Conventional Conforming Fixed Rate Loans now available!

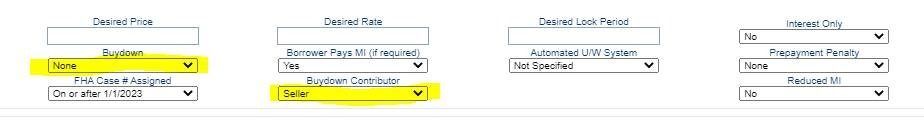

Optimal Blue has a new field to help price the loans properly; Buydown Contributor. The Buydown Contributor will default to “Seller” * in the Optimal Blue system. As shown below:

*If you do not have a buydown the Contributor will still show Seller on the screen but have no impact to your file until the Buydown option is selected

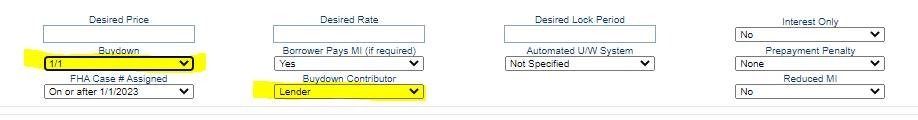

If you are looking for Lender Paid Buydown Option you need to select the Buydown amount and then change the contributor to “Lender”.

The price change will be reflected on the lock and will include a price adjustment on the loan.

For Lender Paid Buydown, your loan program name will be appended to add “BD- L” — for example, “GMFS-Fannie 30 yr. – BD-L” you can distinguish the difference in the name from the Seller Paid as it is “BD-S”. Any change in the contributor will require an update to your lock and potentially disclosures.

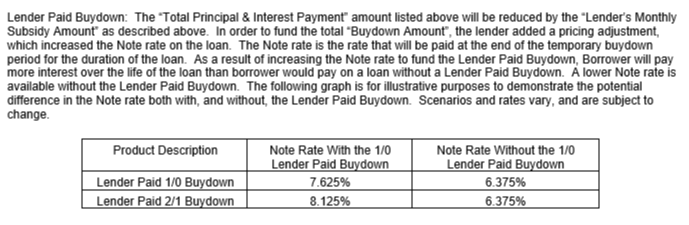

The Lender Paid Buydown Option will have specific Lender Paid Temporary Buydown Disclosure in the initial disclosure package, which must be signed by the borrower. This same disclosure will also be included in the closing package and must be signed by both the borrower and lender representative. To prevent any confusion or future concerns from the borrower, it is important that the borrower understands that on a lender paid buydown, the Note rate is higher at the end of the buydown period than the Note rate on a loan without the lender paid buydown option. The Lender Paid Buydown Disclosure provides the customer with illustrative examples of the pricing difference both with and without the lender paid buydown. Familiarize yourself with the rate differences and communicate these differences to the borrower so they can make an informed decision. The language from the disclosure is as follows:

If client chooses to disclose, you must use the GMFS Lender Paid Disclosure Agreement.

Please submit with your documents at submission. The Buydown Disclosure will be required prior to submitting for closing.