2024 Conventional Updated AMI Limits

FNMA and Freddie Mac have announced the release of new 2024 AMI Limits, effective May 19, 2024.

However, each agency has also released their own specific guidelines on when to apply these new limits for current loans.

FNMA (from Selling Guide Update effective May 19, 2024)

- Lenders must use the 2024 AMI limit for manually underwritten loans with application dates on and after May 19

- As in past years, we will continue to apply the AMIs in DU based on the casefile creation date. DU will apply the 2024 limits to new DU loan casefiles created on or after May 19

- Loans with Application Received Dates prior to May 19 will use the 2023 AMI limits, and loans with Application Received Dates on and after May 19 will be subject to the 2024 AMI limits for the purpose of applying the waiver.

- For first-time homebuyer loans and Duty to Serve loans eligible for the waiver, DU will continue to issue an Observation message identifying that a loan casefile is eligible for the waiver based on AMI.

Treatment of loans in the pipeline – created in DU and not sold to Fannie Mae before May 19:

- For DU Home Ready loans, DU will use the 2023 AMIs based on the casefile creation date to determine Home Ready eligibility. Application date will not be used to apply the waiver upon sale.

Please make note that this information is a brief breakdown of updates and may not include all guidelines associated with this agency update. Refer to the link below for Bulletin and/or Agency Guidelines: https://singlefamily.fanniemae.com/media/39116/display

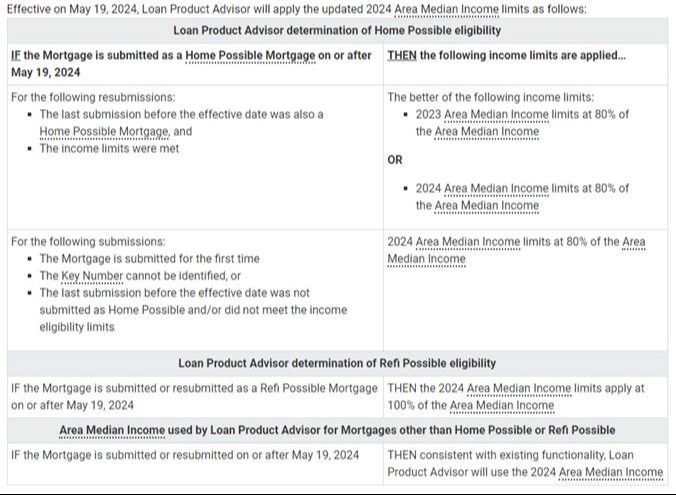

FREDDIE MAC (from Bulletin 2024-C, effective May 19, 2024)

Please make note that this information is a brief breakdown of updates and may not include all guidelines associated with this agency update. Refer to the link below for Bulletin and/or Agency Guidelines: https://guide.freddiemac.com/ci/okcsFattach/get/1009250_7